US gas prices are heading back to February lows

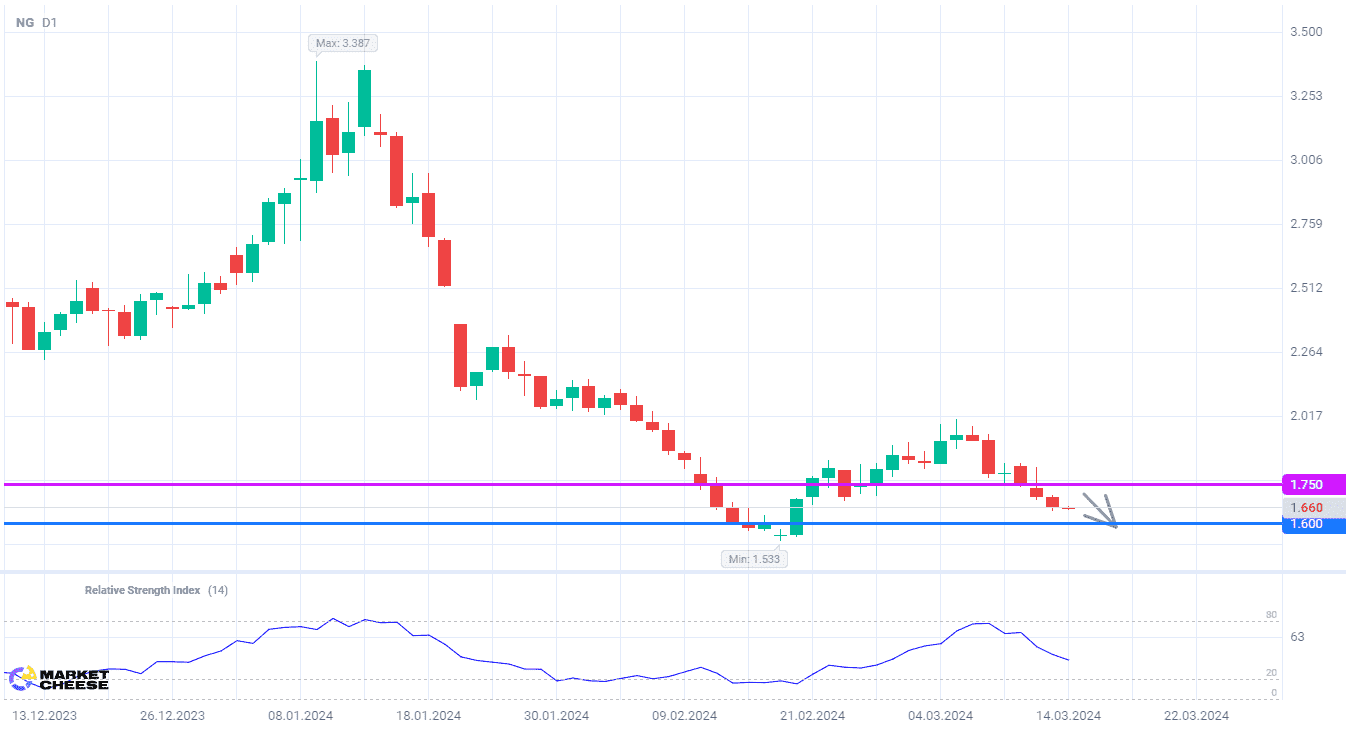

US natural gas prices, as expected, completed their rebound from 4-year lows at 2. The buyers failed to continue the upward movement, and the price reversed. By now 75% of the previous growth wave has been leveled off, and the gas price is gradually returning to February levels. There are still not enough prerequisites to break the long-term negative trend in the gas market.

According to the US Energy Information Administration (EIA), the collapse in fuel prices will cause minor changes in production and demand levels. Thus, average daily gas production in 2024 will drop by only 0.4% to 103.35 billion cubic feet per day. Domestic consumption will increase by 0.7% to 89.68 billion cubic feet per day. This is certainly not enough for a tangible shift in gas prices.

Expanding LNG supplies could at least slightly improve the situation for US gas producers. However, the amount of feedstock entering LNG export plants has been declining in recent weeks. March deliveries fell to 13.4 billion cubic feet per day from 13.7 billion in February. Reuters analysts do not expect an increase in gas supplies to US LNG plants until repairs at Freeport are completed.

Overseas markets remain muted due to the fall in LNG prices. China and South Asia are increasing imports, but at a modest pace. Reuters forecasts Asian LNG buying will grow only by 4.2% in March compared to the same month in 2023. Meanwhile, Japan and South Korea continue to cut imports because the prices in their long-term contracts are tied to the cost of oil.

On the daily chart of natural gas, the RSI is moving downward, but it is still far from the oversold zone. Thus, there are no technical obstacles for further decline in prices to the level of 1.6.

Consider the following trading strategy:

Sell gas at the current price. Take profit – 1.6. Stop loss – 1.75.

Traders may also use a Trailing stop instead of a fixed Stop loss at their discretion

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account