USDCAD growth strengthens ahead of BOC rate decision

The USDCAD currency pair is rising moderately on Wednesday as traders await the weakening of the Canadian dollar due to a probable interest rate cut by the Bank of Canada (BOC). According to the country's statistical office, market participants are pricing in about an 80% chance of a reduction in borrowing costs from 5% to 4.75%.

The Canadian dollar has been the second-weakest performer in the Group of 10 since the end of March, trailing only the Japanese yen. According to recent Commodity Futures Trading Commission data, asset managers and hedge funds have kept their wagers against the Canadian dollar at a seven-year high.

Meanwhile, the US dollar index has moderately rebounded from a more than two-month low hit on Tuesday, regardless of disappointing macroeconomic data from the US.

The Job Openings and Labor Turnover Survey (JOLTS) showed a fall in job openings by 296,000 to 8.059 million in April. This was the lowest level for more than three years and followed a disappointing release of manufacturing PMI from ISM, indicating weak business activity and signs of a cooling economy in the US.

Now the volatility in the currency market is quite moderate as investors are taking a wait-and-see attitude prior to the publication of important economic data, including Friday’s US non-farm payrolls report.

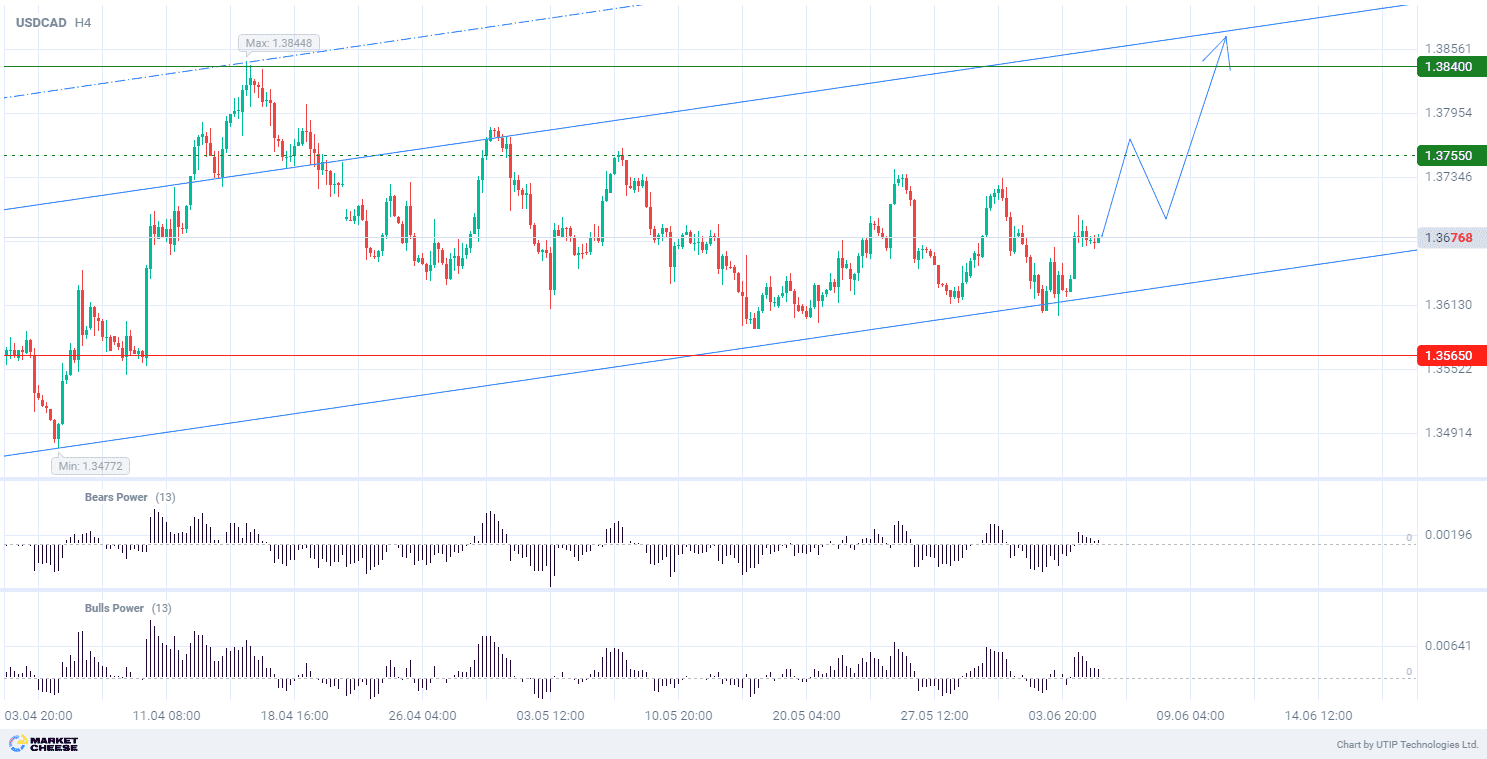

At the technical level, the USDCAD currency pair is forming an upward correction trend on the D1 timeframe. The price has pulled back from the channel support, confirming the strength of the uptrend. The Bulls Power and Bears Power indicators (standard values) are in the positive zone, indicating further growth.

Signal:

The short-term outlook for the USDCAD pair suggests buying.

The target is at the level of 1.3840.

Part of the profit should be taken near the level of 1.3755.

A stop-loss could be placed at the level of 1.3565.

The bullish trend is short-term, so trade volume should not exceed 2% of your balance.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account