USDCAD is in downtrend amid expectations of rate cuts in the U.S. and Canada

USDCAD fell to a five-month low amid expectations of new signals from the Federal Reserve regarding the extent of interest rate cuts and the upcoming publication of Canadian GDP data.

On Tuesday, data was released showing that U.S. consumer confidence hit a six-month high in August. However, traders are becoming more anxious about the labor market.

Market participants are now focused on the U.S. personal consumption expenditure (PCE) data, due on Friday. This figure is the Fed's preferred measure of inflation.

Last week, Federal Reserve Chair Jerome Powell endorsed an imminent start to rate cuts and expressed confidence that inflation is within reach of the 2% target. According to the CME FedWatch tool, markets are pricing in about a 67% chance of a 25 basis points U.S. rate cut.

Meanwhile, Statistics Canada forecasts that Friday's gross domestic product data will show the economy grew at a 1.6% annualized rate in the second quarter. By comparison, the Bank of Canada's latest forecast called for a 1.5% rise.

Currency movements are still driven by the prospects of interest rate cuts in the U.S. and Canada. However, the USDCAD rate is mainly formed by American statistics.

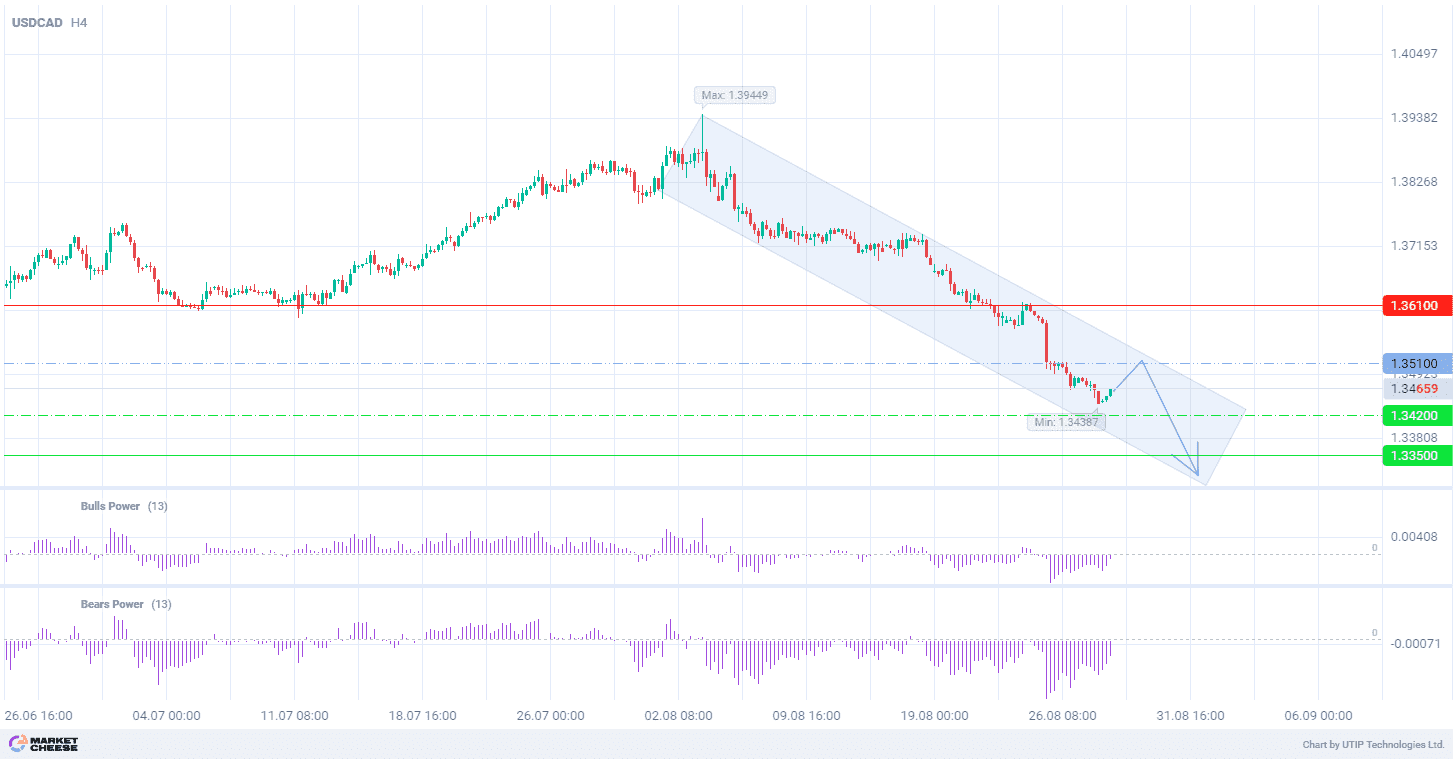

From the technical point of view, the USDCAD currency pair is forming a new downward trend on the H4 timeframe. The Bears Power and Bulls Power (standard values) are in the negative zone, which signals the continuation of the current trend and potential decline in the currency pair. At the same time, the news background of the second half of the week may correct the currency pair to the upper boundary of the channel.

Signal: The short-term outlook for the USDCAD pair is to sell near the level of 1.3510.

The target is near the level of 1.3350.

Part of the profit should be fixed near the level of 1.3420.

The Stop loss could be placed near the level of 1.3610.

The bearish trend is of a short-term nature, so it is suggested to limit the trading volume to no more than 2% of your capital.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account