USDCAD is rising in anticipation of US inflation data

The USDCAD currency pair is rising moderately on Wednesday as traders await key US inflation data. The figure could have an impact on the Fed's future interest rate policy.

Hawkish comments from several Fed officials strengthened the US dollar. Fed Minneapolis President Neel Kashkari said that the central bank should wait for significant progress on inflation before cutting interest rates. He expects no more than two rate cuts in 2024.

Gold traders will keep an eye on the Fed’s Beige Book and the Fed’s John Williams speech on Wednesday. The release of the US Personal Consumption Expenditures price index (PCE) will take centre stage on Friday. The Fed expects the index to show an increase of 0.3% MoM and 2.8% YoY in April. Any signs of stickier inflation could trigger the possibility of delaying the rate cut in the US.

As for Canada, traders await GDP data, due on Friday. Statistics Canada predicts the economy grew at an annualized rate of 2.2% in the first quarter. This figure is lower than the 2.8% mark projected by the Bank of Canada (BoC) in April. This data could affect expectations of interest rate changes in the country.

The market participants see a 64% chance the BoC would begin an interest rate-cutting campaign at a policy decision on June 5.

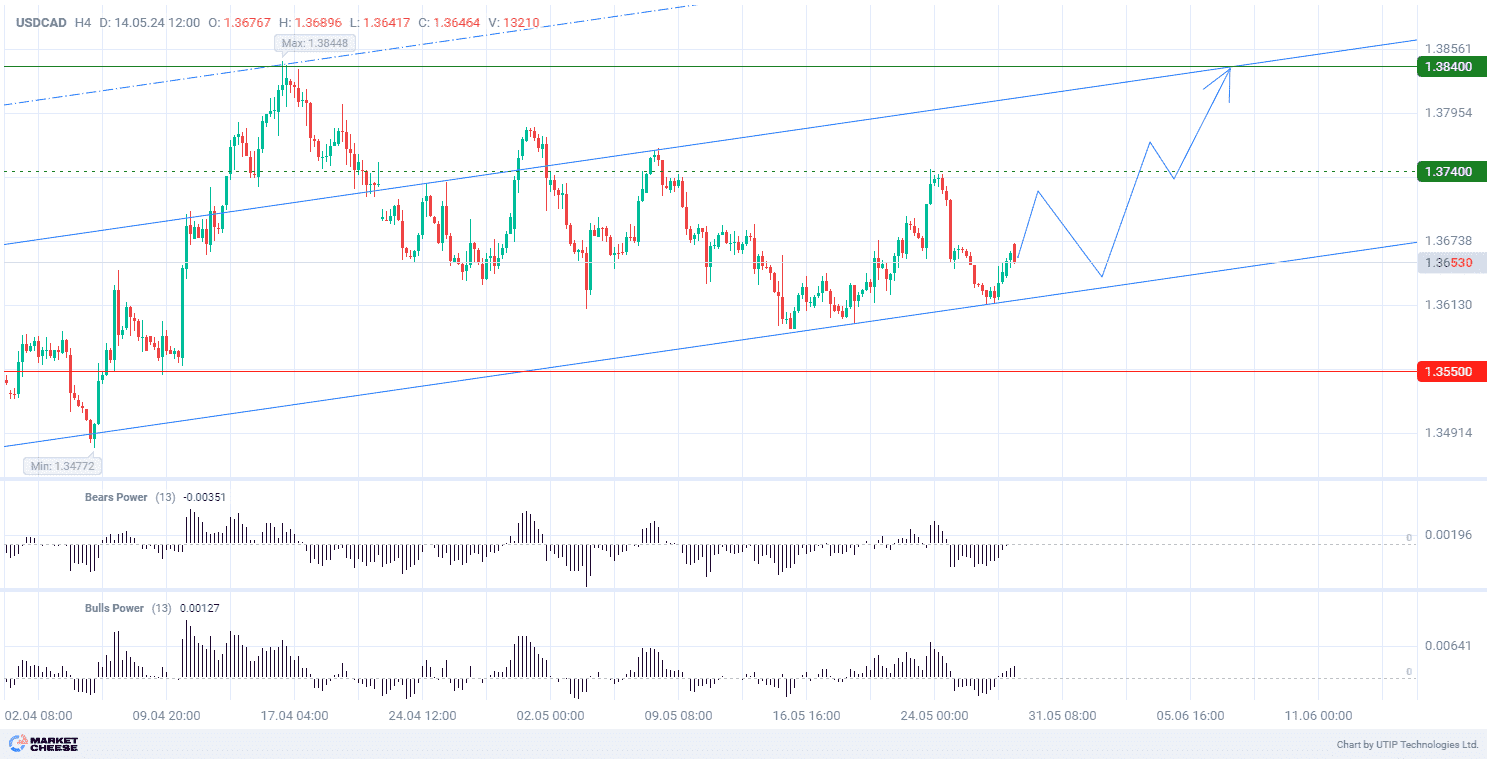

From a technical point of view, the USDCAD currency pair is forming an upward corrective trend on the D1 timeframe. The price has rebounded from the channel support, confirming the strength of the uptrend. Bulls Power and Bears Power (standard values) are in the positive zone, indicating the continued growth.

Signal:

The short-term outlook for the USDCAD pair is to buy.

The target is near the level of 1.3840.

Part of the profit should be fixed near the level of 1.3740.

The Stop-loss could be placed near the level of 1.3550.

The bullish trend is of a short-term nature, so it is suggested to limit the trading volume to no more than 2% of your capital.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account