USDCAD pullback from two-month high continues

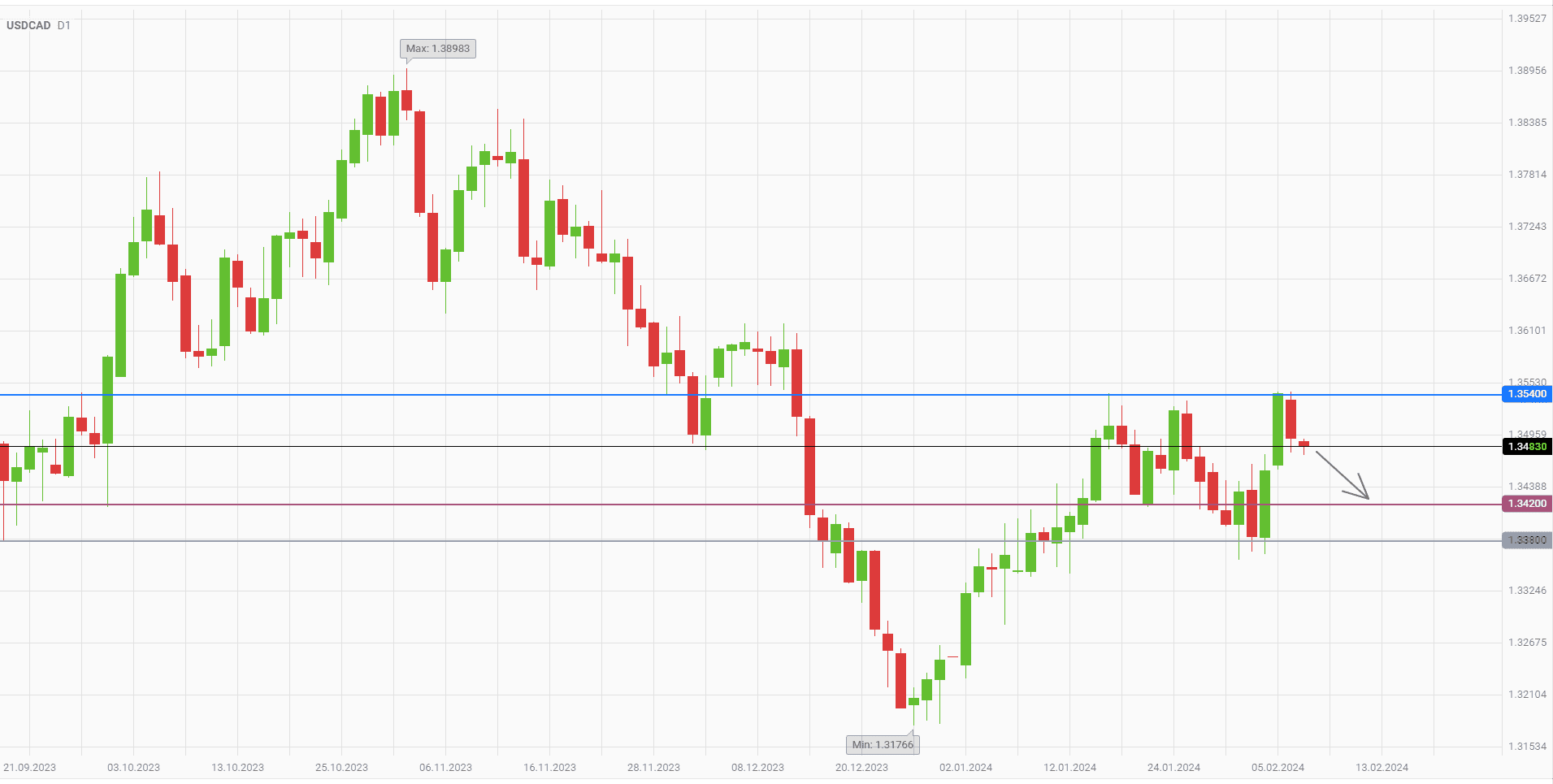

The USDCAD currency pair at the beginning of this week updated the maximum since mid-December. However, it failed to consolidate above 1.354, as it did a month earlier. At yesterday's trading session USDCAD sellers, having received support from hawkish comments of the head of the Bank of Canada, intercepted the initiative. The corrective pullback of the price after two sessions of strong growth was justified, and the downward momentum of Tuesday has good chances to continue.

The rigid position of the Canadian regulator received an additional factor of support. Business activity in the country's economy in January reached the maximum level for 9 months. PMI grew from 56.3 to 56.5 points with expectations of its fall to 55. Excluding seasonality, the increase of the index was even more impressive — from 43.7 to 54.4 points. In such a situation, talks and even more so decisions on reduction of interest rates will be unjustified.

Analysts of Scotiabank paid attention to another sign of a long period of preservation of the current monetary policy. At the end of last week the Bank of Canada announced the resumption of auctions on placement of temporarily free funds of the country's government. These operations had been halted in August 2020, but now there is a renewed need for them.

Taylor Schleich of the National Bank of Canada interprets this step of the regulator as an attempt to expand the access of financial market participants to liquidity. Now in Canada the rate of short-term financing through repo mechanism is higher than the key rate. Last week, this difference reached a new high of 0.07%. According to Schleich, if the return of auctions will equalize the cost of repo with the key rate at 5%, the Bank of Canada will have the opportunity not to change the monetary policy until July. This would support the local currency.

After a downward reversal from the level of 1.354, the nearest target for the bears in USDCAD trading is around the mark of 1.342. In case of success, the lows of February, located just below the level of 1.338, can be tested.

The following trading strategy can be suggested:

Sell USDCAD at the current price. Take profit — 1.342. Stop loss — 1.354.

Traders can also use a Trailing stop instead of a fixed Stop loss at their discretion.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account