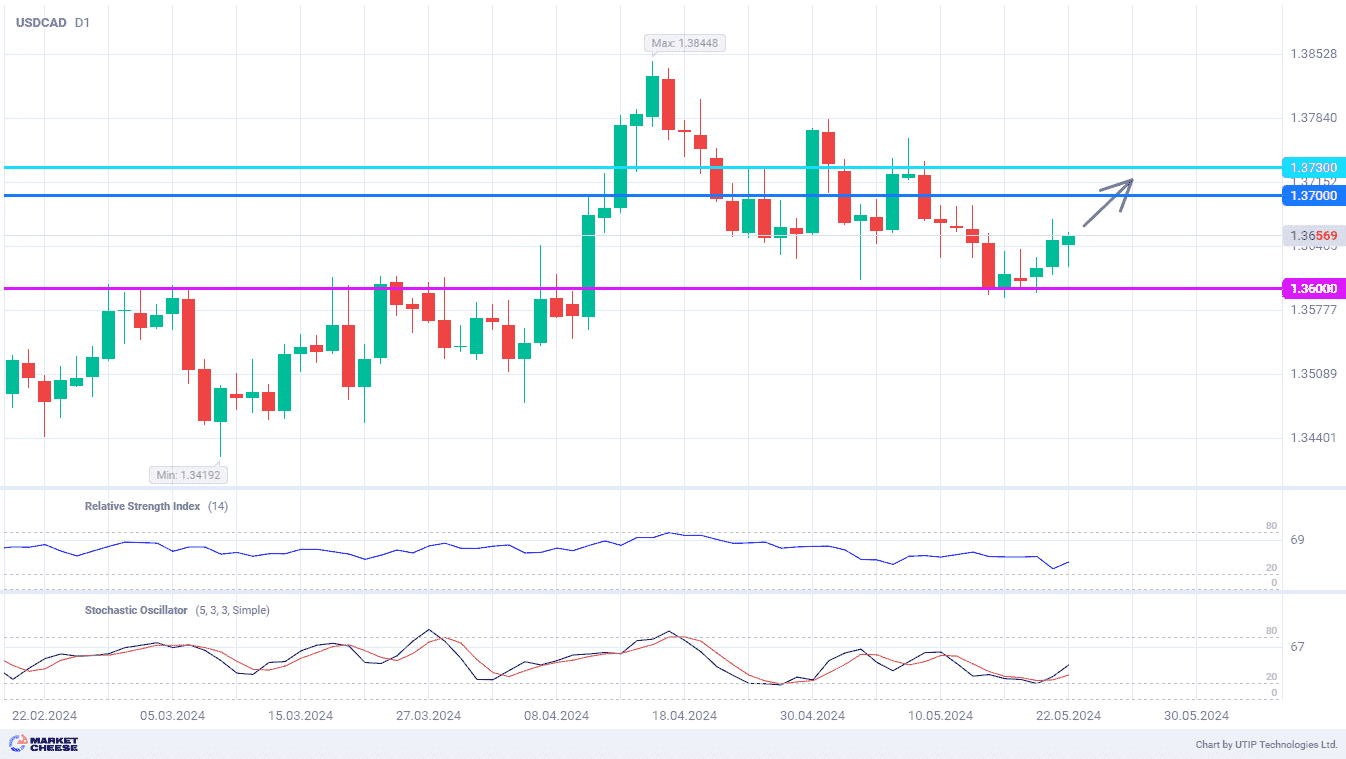

USDCAD recovery aims to climb above 1.37

The USDCAD currency pair reached the important level of 1.36 last week, where the monthly downward movement finally stopped. Quotes have been trying to turn upward for several days, and yesterday the bulls managed to seize the initiative. The price showed a good growth, but there is still a great potential for recovery ahead. Now the main targets for USDCAD buyers is 1.37 and 1.373.

The inflation data for April contributed to a significant weakening of the Canadian dollar. The overall consumer price index fell from 2.9% to 2.7%, in line with analysts' expectations. At the same time, core inflation slowed more strongly than forecasts, amounting to 2.75% after the March level of 3.05%. Positive price dynamics in Canada have been maintained for 4 months in a row, giving reason for easing of monetary policy soon.

Bank of Canada Governor Tiff Macklem welcomed the release of inflation statistics, noting its movement in the right direction. According to analysts surveyed by Bloomberg, the chances of a key rate cut at the end of the meeting on June 5 rose from 40% to 60%. Royce Mendes from Desjardins Securities considers the available data as quite sufficient sign of normalization of price growth pace.

Scotiabank experts, historically more hawkish, have also changed their expectations regarding the actions of the Canadian regulator. Earlier they predicted the first rate cut only in September, but now they consider the July meeting as a more probable date. Now all 6 of Canada's largest banks expect a monetary policy easing cycle to begin during the summer. Jean-Francois Perrault, chief economist at Scotiabank, notes the great importance of the country's final GDP report for the first quarter. It will be published on May 31, and if the preliminary estimate of 2.5% growth is confirmed or worsened, there will be no more obstacles for rate cuts.

On the technical indicators RSI and Stochastic, one can see reversal signals confirming the beginning of USDCAD upward movement. Reaching the levels of 1.37 and 1.373 is quite possible on the horizon of the next few days.

The following trading strategy may be offered:

Buying USDCAD at the current price. Take profit 1 – 1.37. Take profit 2 – 1.373. Stop loss – 1.36.

Traders may also use a Trailing stop instead of a fixed Stop-loss at their discretion.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account