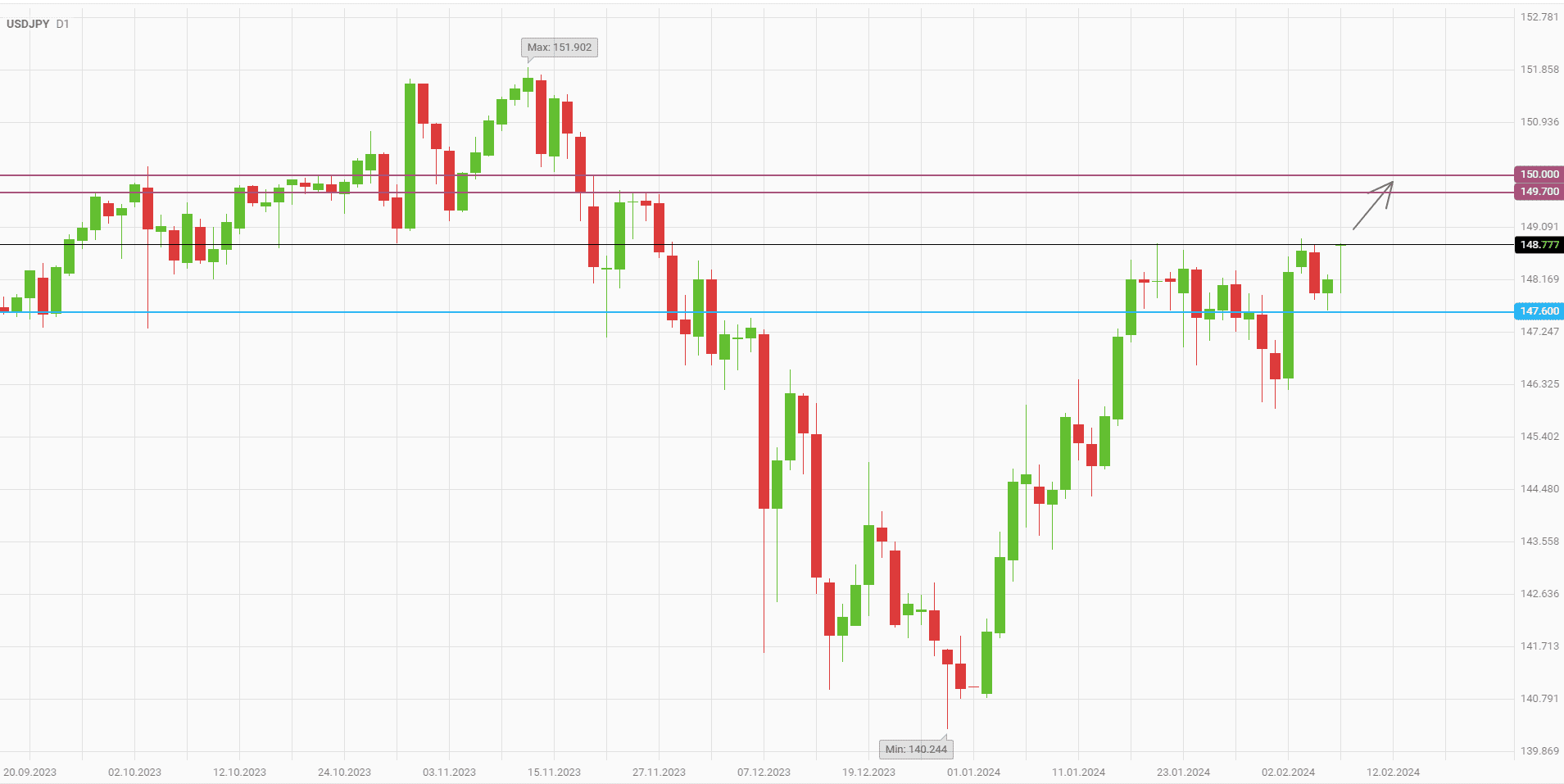

USDJPY is approaching new 2024 highs

At the start of Thursday's trading session, there was increased volatility in the USDJPY currency pair. Despite the attempts of the bears to take the quotes back to Wednesday's values, the buyers still managed to maintain the major gains. The price once again stopped just below the level of 149, and its breakthrough could open the way to the highs of the past fall. It’s quite likely that now the upward movement is strong enough for hitting the levels of 149.7 and 150.

Yesterday's speeches of the Fed officials strengthened the dollar against the yen. Board of Governors member Adriana Kugler, Boston Fed president Susan Collins, Minneapolis Fed president Neel Kashkari and Richmond Fed president Thomas Barkin shared their views. All of them reported that there is no need for rapid monetary policy easing. Market participants aren’t pricing in the March key rate cut anymore, focusing more on the May 1 meeting.

Perhaps, by the Fed’s May meeting, the Bank of Japan will have already increased rates for the first time since 2007. However, its influence on the yen rate against the US currency is unlikely to be significant. The Japanese regulator, unlike its colleagues from Western countries, won’t tighten the monetary policy rapidly and aggressively. This was announced today by Deputy Governor of the Bank of Japan Shinichi Uchida.

According to Uchida, monetary policy reversal shouldn’t radically worsen the situation in the Japanese financial market. Soft conditions should be preserved. In particular, it concerns the purchase of bonds by the Bank of Japan. The official warned investors against expecting the same rapid increase in rates, which happened over the past 2 years in the US and most other developed countries. In this regard, the yen will maintain its long-term weakness.

For a breakout to the 2023 highs, the USDJPY bulls should consolidate near the 150 mark. At least part of the profit should be fixed at that level. In case of a corrective pullback it’s recommended to restore long positions.

The following trading strategy can be suggested:

Buy USDJPY at the current price. Take profit 1 — 149.7. Take profit 2 — 150. Stop loss — 147.6.

Traders can also use a Trailing stop instead of a fixed Stop loss at their discretion.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account