USDJPY is on track to fall near 136.00 amid expectations of further Fed rate cuts

The USDJPY currency pair is showing gains on Thursday as traders remain uncertain about the pace of further narrowing of the spread between Japan and the U.S. interest rate levels.

Last week, the Federal Reserve cut interest rates by half a percent. However, Chairman Jerome Powell sowed doubts among investors regarding the pace and volume of further monetary easing by the regulator. At the same time, Bank of Japan Governor Kazuo Ueda emphasized that the central bank is in no rush to raise interest rates. That creates a spread in yields between the two countries.

The U.S. dollar is now under pressure amid growing expectations of further interest rate cuts by the Federal Reserve at its upcoming meetings. According to the CME FedWatch tool, there is a 58% chance of another half-percent rate cut in November.

Today, investors' attention is focused on Jerome Powell's speech, which may provide additional signals on future monetary policy.

Despite the yen strengthening by 11% this quarter after hitting a 38-year low against the dollar, the market participants remain concerned about a further widening of the yield difference. Japan is still facing equity outflows, trade deficits and negative real interest rates. These factors put pressure on the national currency.

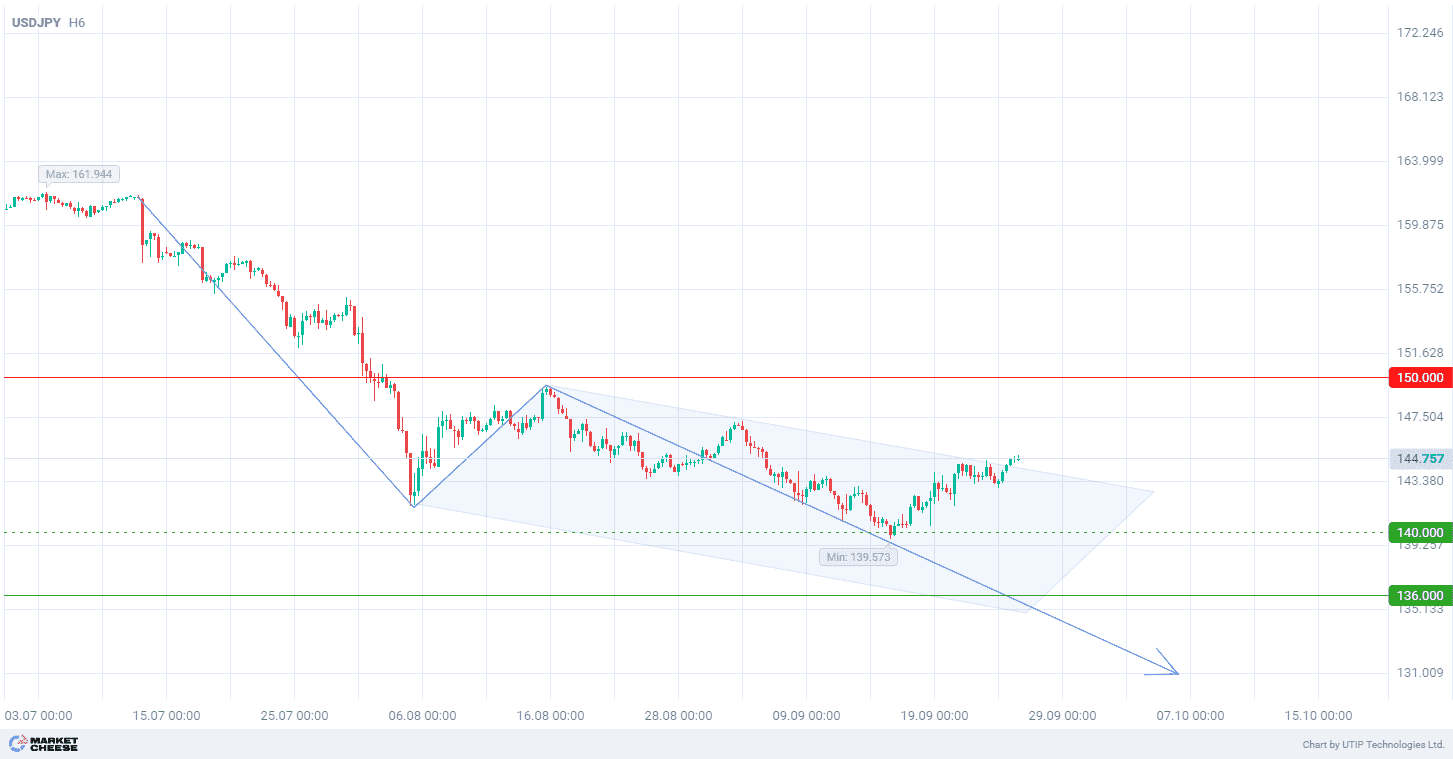

On the technical level, the USDJPY quotes went beyond the downward correction on the H6 timeframe. According to the wave analysis, the price is in the formation of the third downward wave. The breakdown of the top of the first wave at 141.75 has already occurred. This indicates a possible strengthening of the downward impulse, despite the current consolidation of the pair.

Signal:

The short-term outlook for the USDJPY currency pair is to sell.

The target is at the level of 136.00.

Part of the profit should be taken near the level of 140.00.

The Stop-loss is placed at the level of 150.00.

The bearish trend has a short-term nature, so it is worth keeping the volume of trade to no more than 2% of your balance.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account