USDJPY is rising due to Fed’s rate cut forecast revision

The USDJPY currency pair stabilized on Thursday near last year's high of 151.90 as the U.S. dollar slowed down a bit. Market participants try to determine when the Federal Reserve (Fed) will begin cutting interest rates. Investors revise their forecasts due to the release of new data on inflation in the United States.

This week, the yen was under pressure again. The reason was the transition of the Japanese economy into recession after two quarters of negative growth. The real GDP of the country grew by 1.9% in 2023. The nominal gross domestic product (GDP) of Japan at the end of 2023 in terms of dollars amounted to $4.21 trillion.

Economic indicators pose a problem for the government and the Bank of Japan as they strive to achieve economic growth by stimulating domestic demand and raising wages. In addition, Japanese companies remain extremely cautious about long-term investment, which is also a negative factor for development.

As for economic indicators in the United States, new data on inflation forced analysts to revise their expectations about the first rate cut by the Fed. Now the market predicts a reversal of the regulator's policy by the middle of the year. In January, the consumer price index in the United States rose by 3.1% in annual terms, compared to the previously estimated 2.9%.

Chicago FRB President Austan Goolsbee said the central bank will stick to its course even if prices rise more in the coming months.

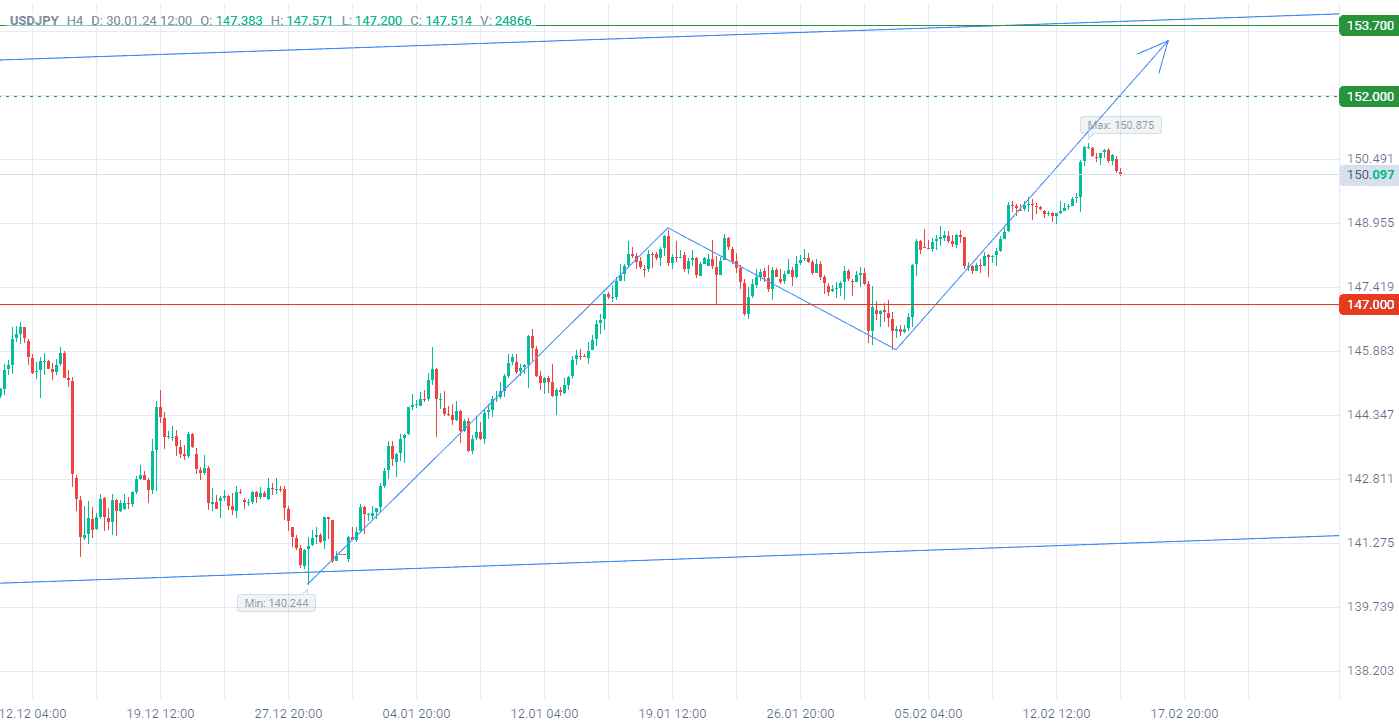

USDJPY quotes are in the formation of a corrective uptrend on the D1 time frame.

In terms of wave analysis, the price is in the process of forming the third ascending wave on the H4 timeframe. The breakthrough of the top of the first wave at 148.80 has already taken place. The upward movement may intensify in the near term.

Signal:

The short-term outlook for USDJPY is to buy.

The target is at the level of 153.70.

Part of the profit should be fixed near the level of 152.00.

A Stop-loss should be placed at the level of 147.00.

The bullish trend has a short-term character, so the trade volume should not be more than 2% of your balance.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account