USDJPY plunges as bullish positions get liquidated

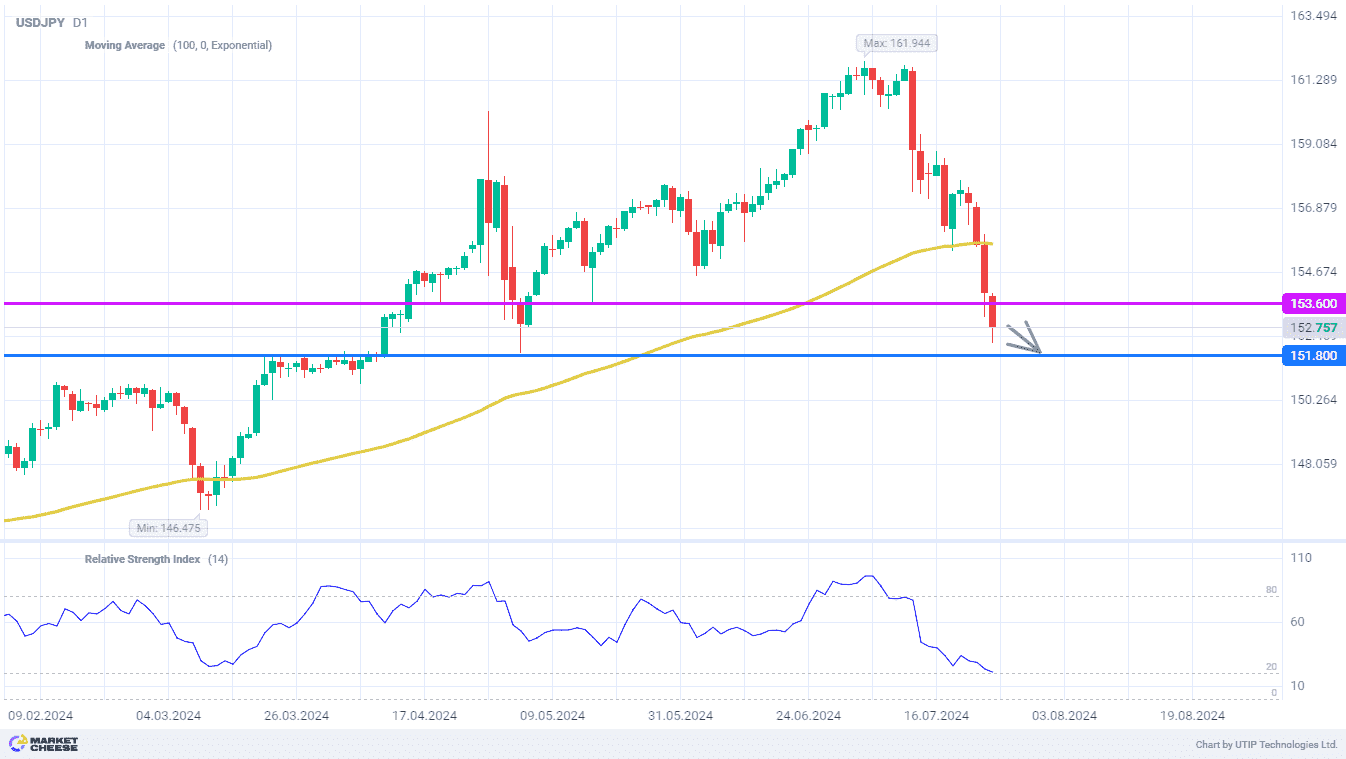

The USDJPY currency pair is rapidly moving downward this week, regularly updating summer lows. The high rate of decline has caught many market participants by surprise, who were forced to urgently close long positions on the dollar against the yen. Bears have already made a good profit, but another target in the form of 151.8 is very close. It corresponds to the May bottom, as well as a strong resistance level of late March-early April. Here the sharp strengthening of the Japanese currency can stop.

The current wave of yen growth is attributed by the majority of currency market participants to the next interventions of the Bank of Japan. However, the bank has changed its policy this year and no longer gives operative comments on its interventions in the yen exchange rate. It will be possible to understand the true scale of efforts of the Japanese central bank only in August, when the report for July will be released. Nevertheless, Reuters analysts believe that the Bank of Japan has already spent about 6 trillion yen ($38.4 billion) since the beginning of this month.

Bloomberg experts believe that hedge funds and other large investors began to massively close long positions on USDJPY after the breakout of quotes below the level of 155 and the line of 100-day moving average. At the same time, bets on the weakening of the yen exceeded $12 billion, and the effect of a sharp decline in this value can be manifested for a long time. According to the U.S. Commodity Futures Trading Commission, the ratio of the U.S. and Japanese currency has seen the strongest shift over the past year.

Bloomberg analysts also pay attention to the upcoming meetings of the Bank of Japan and the Fed, scheduled for July 31. The Fed is unlikely to reduce the key rate, but will surely prepare market participants for such a step in September. At the same time, the probability of the Bank of Japan tightening its monetary policy is estimated at almost 50%. The interest rate gap between Japan and the U.S. is still large, but its gradual reduction plays in favor of USDJPY decline.

The RSI indicator on the daily chart of USDJPY is close to the oversold condition, but there is no signal for a bounce upwards. In this regard, the level of 151.8 may well be reached before the central bank meetings next Wednesday.

The following trading strategy may be offered:

Sell USDJPY at the current price. Take profit – 151.8. Stop-loss – 153.6.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account