Waiting for another attempt by the Bank of Japan to stop rapid decline of the yen

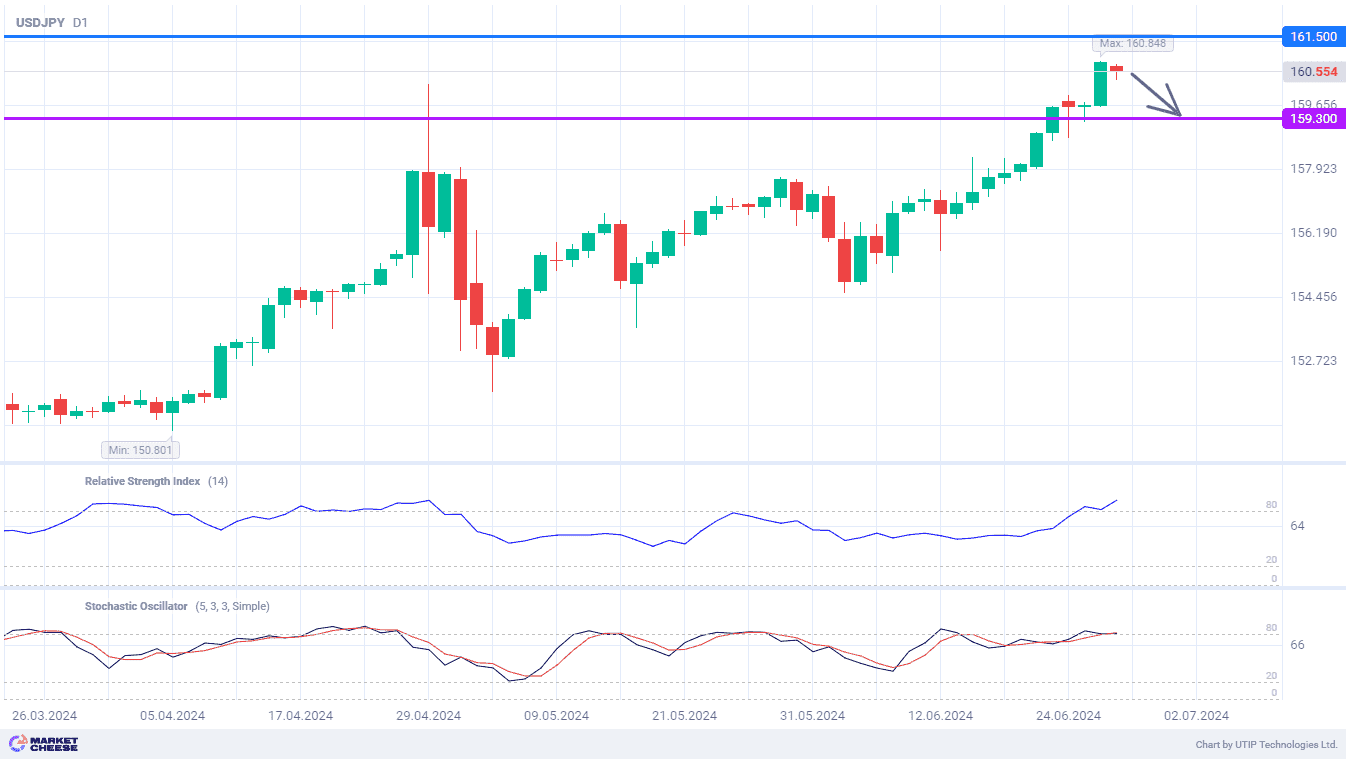

The USDJPY currency pair at Wednesday's trading session exceeded the 160 level for the first time in 2 months. At the end of April, the price reaching this level forced the Bank of Japan to conduct currency interventions, which eased the pressure on the yen. However, the effect of the regulator's measures was fleeting, and the currency market participants quickly returned to stable purchases of USDJPY. In such a situation, the Bank of Japan will be forced to take active actions again, otherwise the yen’s devaluation will accelerate significantly.

Earlier, the Japanese authorities said that they are concerned about the rate of depreciation of the national currency, and the specific levels of quotations aren’t that important. However, with the price exceeding the 160 level, this point of view is called into question. Masafumi Yamamoto, chief currency strategist at Mizuho Securities, noted Finance Minister Shunichi Suzuki's increased concern at today's press conference. The yen's new 38-year low against the dollar calls for action.

Carol Kong, an analyst at Commonwealth Bank of Australia, said a decision on new currency intervention is likely to be made by the end of this week. 2 months ago, the Bank of Japan spent almost 10 trillion yen (more than $60 billion) to support the national currency. According to Bloomberg, traders in recent days have sharply increased demand for hedging their short yen positions, fearing the regulator's interference in currency trading.

Another factor in favor of active actions of the Bank of Japan could be tomorrow's statistics on the US economy. The PCE price index for May will be presented. If the Fed's preferred inflation gauge doesn’t show a slowdown, the US currency will strengthen even more. As a result, fundamentally weak currencies such as the yen will be under pressure.

Technical indicators RSI and Stochastic signal a strong overbought condition of USDJPY and a high chance of at least a local correction. Profit taking bulls could push the quotes back to the level of 159.3.

The following trading strategy can be suggested:

Sell USDJPY at the current price. Take profit — 159.3. Stop loss — 161.5.

Traders can also use a Trailing stop instead of a fixed Stop loss at their discretion.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account