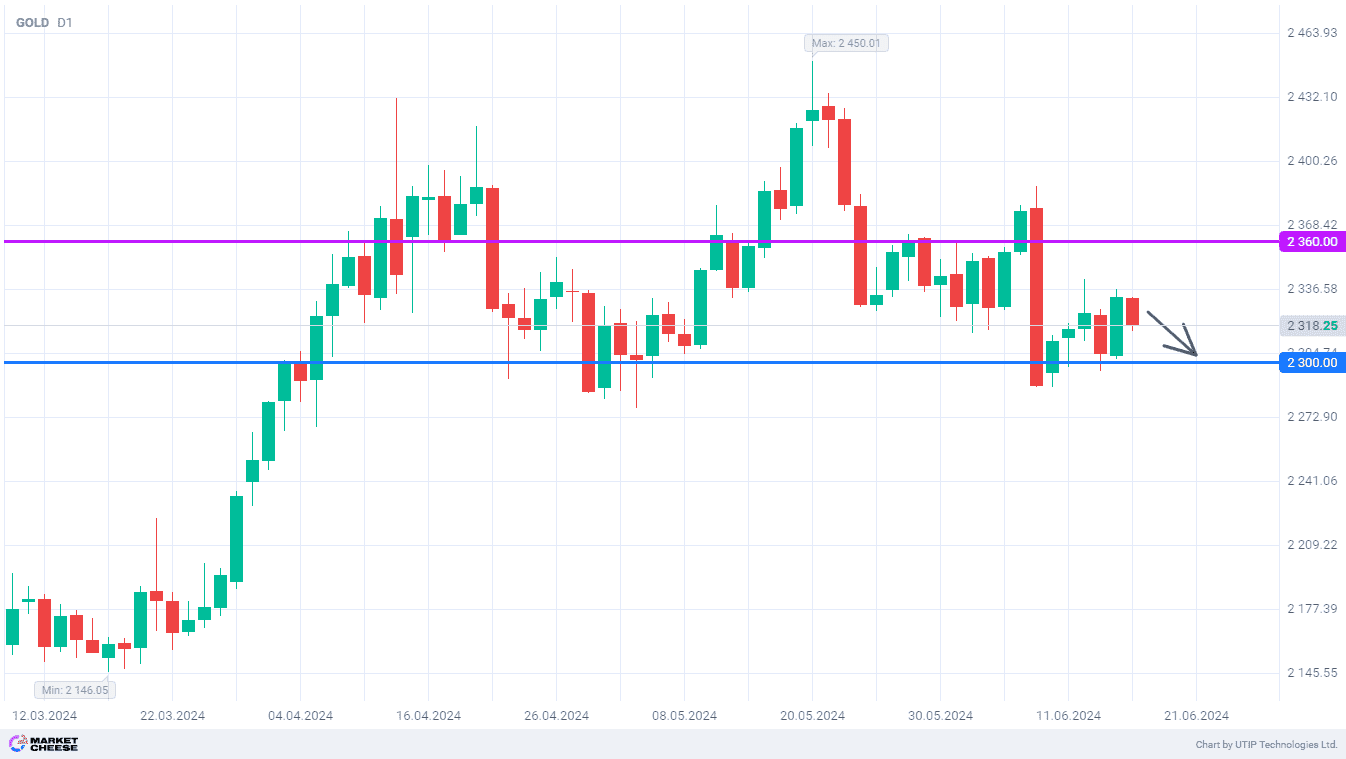

Weak demand will keep gold price near the level of 2300

Gold prices, as expected, held above the support of 2300, but the bulls still can’t help drive a new wave of growth. Buyers of the yellow metal showed increased activity near the monthly lows, but they still don't have enough strength to bring the price back to the recent highs. With some lull in the gold market, quotes could remain near the level of 2300, and growth impulses will provide an interesting opportunity for opening long positions.

Traders are in no hurry to buy out the drawdown, formed on June 7 on the news that the People's Bank of China paused gold purchases. As evidenced by the May report of the World Gold Council (WGC), the decline in demand for the yellow metal in China is even more serious. All segments of the local gold market, with the exception of ETFs, are now on the downside.

Gold withdrawals from the Shanghai Gold Exchange amounted to 82 tons last month. It’s 49 tons less than the April figure and 30 tons lower than the annualized figure. The new historical maximum in gold prices scared off many jewelry buyers. The weakening of demand is also noticeable in local prices. In May, the gold price on the Chinese domestic market was $32 more expensive compared to world quotations. In a month the premium decreased by $10 per ounce.

According to Reuters, a similar situation is observed in India. Local dealers offer gold at a $10 discount to the world price, but there is still no noticeable revival in demand. This is due to expectations of even greater price drops and the end of the wedding season. In other Asian countries consumption of yellow metal is more stable, but without India and China there will hardly be a new gold rally.

Until gold prices won’t recover all the drawdown that took place on June 7, purchases will be restrained. In the short term, the price is unlikely to move away from the level of 2300.

The following trading strategy can be suggested:

Sell gold in the range of 2320–2340. Take profit — 2300. Stop loss — 2360.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account